After two years of virtual meetings, the Advocacy Leadership Conference was once again held in person in Washington, D.C., May 11–13. The conference educates ACR/ARP volunteer leaders about topics important to rheumatologists, rheumatology professionals and their patients that they can then discuss with their members of Congress and staff. One important issue ACR volunteers discussed with their representatives and senators this year was the growing use of copay accumulator programs, which restrict the application of patient assistance funds toward patient cost-sharing requirements.

Dr. Miller

Patient assistance programs provided by pharmaceutical companies make expensive medications more affordable to the patient by funding part of the cost. Manufacturers fund these programs to reduce financial barriers to prescription of their drugs and ensure a profitable net return to the company. The practice has been compared to a form of bribery. That is why insurance companies have concerns about these programs, and management of them has important policy implications.

Ms. Sampson

Let’s say an individual is offered either methotrexate or adalimumab for their rheumatoid arthritis (RA). Normally, a high co-pay on the adalimumab would discourage many patients from taking it. But if AbbVie covers most of the copay, the patient will frequently choose the more expensive drug.

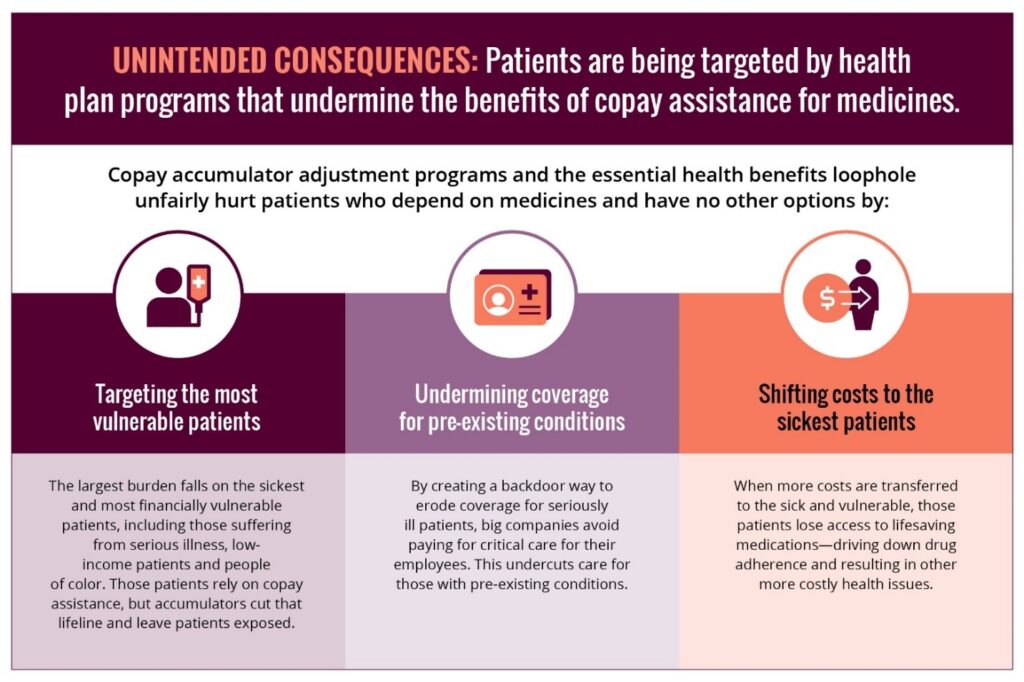

In response, most commercial insurance carriers no longer apply patient assistance program contributions toward patients’ deductibles or out-of-pocket maximums. These copay accumulator programs essentially require a patient pay twice for drug costs: once with an assistance program and again with their own money. This creates an additional financial barrier to treatment for the patient.

Lack of Transparency

A rule from the Centers for Medicare & Medicaid Services finalized in July 2020 allows commercial insurers to use copay accumulators even if a brand name drug has no generic equivalent or appropriate alternative. There is no requirement for transparency from insurers about these programs, often resulting in big surprises for patients.

Many manufacturer copay assistance programs fund a treatment for only one year; after the assistance runs out, patients often cannot afford to pay for the prescription. Patients often don’t even know about these policies until the coupons are no longer usable, and the impact is devastating—often, discontinuation of the drug.

Tami Byklum of North Dakota has a daughter with juvenile arthritis who has been on biologics all through her arthritis journey. Her husband has RA and is on an expensive biologic as well. Her family has a steep deductible before insurance pays 100% of covered services, and they have relied on copay assistance programs to help afford their treatments. Ms. Byklum’s employer changed insurance companies in January 2022, and she was informed the company would no longer recognize third-party payers and copay programs as payment toward their deductible. This meant the family needed to come up with $7,000 at the beginning of the year, and they were in a panic.

Commercial payers and Medicare Part D plans both restrict patient assistance programs. Drug companies currently are not allowed to offer direct support to Medicare Part D patients because of anti-kickback laws. The unintended consequence is that patients may be forced to discontinue effective disease-modifying therapy when they become Medicare Part D beneficiaries.

Keep Treatment Affordable & Accessible

The ACR believes patients should not be denied effective therapies, such as biologics, solely because of their cost. The ACR supports legislation to allow beneficiaries to accept financial copay assistance for specialty cost tier drugs from pharmaceutical companies for Part B and Part D drugs, and it opposes insurance restrictions that prevent application of funds from assistance programs toward patients’ deductibles and out-of-pocket maximum payments.

Fourteen states (i.e., Washington, Arizona, Nebraska, Oklahoma, Louisiana, Arkansas, Illinois, Kentucky, Tennessee, West Virginia, Virginia, North Carolina, Georgia and Connecticut) and Puerto Rico have passed bills to ban copay accumulator programs. These laws are aimed at ensuring patients can remain on their medications and at preventing insurers and pharmacy benefit managers from unfairly taking payment from both the copay assistance source and the patient for the same cost-sharing requirement.

Nationally, the bipartisan Help Ensure Lower Patient (HELP) Copays Act (H.R. 5801) eliminates barriers to treatment for patients by ensuring that they can apply all copays toward the necessary medications prescribed by their doctors and ensuring all copays count. It clarifies the Affordable Care Act definition of cost-sharing to ensure payments made “by or on behalf of” patients count toward their deductible and/or out-of-pocket maximum.

The HELP Copays Act was introduced in November 2021, sponsored by Reps. Donald McEachin (D-Va.), Rodney Davis (R-Ill.), Bonnie Watson Coleman (D-N.J.), Bobby Rush (D-Ga.), Brian Fitzpatrick (R-Pa.), Yvette Clarke (D-N.Y.), Marc Veasey (D-Texas) and Buddy Carter (R-Ga.).

In May, Advocacy Leadership Conference participants asked members of the House to support H.R. 5801 and senators to introduce a companion bill. This legislation would bring relief to patients with rheumatic diseases by ensuring that all payments—whether they come directly out of a patient’s pocket or with the help of copay assistance—count toward their out-of-pocket costs.

Although things can move slowly on Capitol Hill, advocacy makes a difference. The ACR Government Affairs Committee is an important resource for members and includes both ACR and ARP volunteer members.

We highly recommend getting involved at the national and/or state level to let your representatives know your concerns. With the ACR/ARP, you have a group of dedicated volunteers and staff who can answer your questions and provide resources to help you get started.

GLOSSARY

Coinsurance – The percentage of costs of a covered healthcare service paid by a patient (e.g., 20% coinsurance) after they have paid their deductible.

Copay – A flat fee paid by a patient to access healthcare services.

Copay accumulator adjustment program (CAAP) – A program within an insurance plan whereby a manufacturer’s copay assistance program payments do not count toward the patient’s deductible and out-of-pocket maximum. The manufacturer copay assistance pays for prescriptions until the maximum value is reached; only then do the patient’s costs begin counting toward their annual deductible and out-of-pocket maximum.

Cost sharing – The share of costs covered by insurance that a patient pays out of their own pocket. This term generally includes deductibles, coinsurance and copays or similar charges.

Deductible – The amount a patient needs to pay before health insurance will cover services.

Out-of-pocket costs – Expenses for medical care that are not reimbursed by insurance, including deductibles, coinsurance and copays for covered services, as well as all costs for services that aren’t covered.

Out-of-pocket maximum – The total maximum amount a patient may have to pay during any given plan year.

Donald Miller, PharmD, is professor of pharmacy practice, North Dakota State University, Fargo.

Laura Sampson, PA-C, practices at Arnold Arthritis & Rheumatology in Skokie, Ill.