Image Credit: sak55/shutterstock.com

On Nov. 2, 2015, Congress passed the Bipartisan Budget Act of 2015. The Act contained a nasty surprise change to Social Security claiming strategies. Two commonly recommended strategies are known as file and suspend and restricted application. Both of these strategies will be going away, but not immediately. A lucky few will be grandfathered in.

The file-and-suspend strategy allows someone to file for benefits at normal retirement age, and then immediately suspend them. This would allow a spouse to claim spousal benefits based on the filer’s earnings record. The Bipartisan Budget Act of 2015 eliminates this strategy on April 29, 2016. If you suspend benefits after that date, benefits paid based on your record would be suspended, as well.

The restricted-application strategy allows someone to apply for spousal or divorced spousal benefits without applying for their own. This allows their own benefit to continue receiving 8% delayed retirement credit increases. This strategy is being eliminated for anyone born on or after Jan. 2, 1954. Therefore, those lucky couples who were born prior to Jan. 2, 1954, will still be able to cash in on this strategy that can dramatically increase your total lifetime benefits.

How does this affect you?

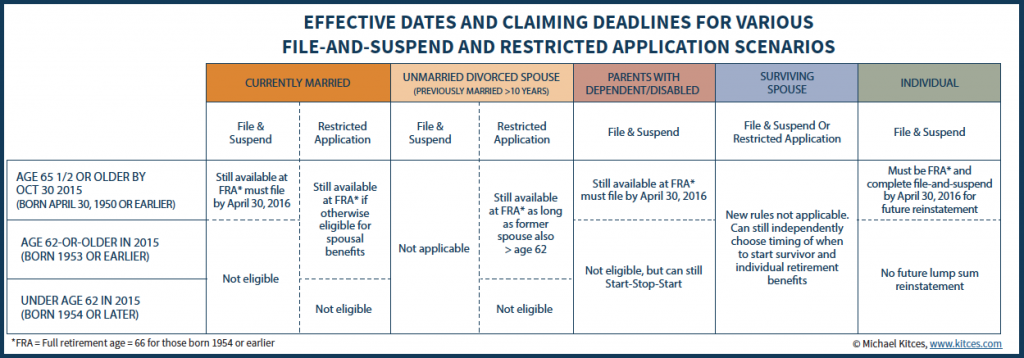

Table 1 summarizes how popular Social Security claiming strategies are affected by when you were born.

Were You Born April 30, 1950, or Earlier?

If so, then you are grandfathered in under the old rules. Between the ages of 65 and 70 you have planning opportunities available. If you have not applied for benefits yet, you should be filing and suspending prior to April 29, 2016. If you are married, were previously married for 10 or more years or are widowed, then a combination file-and-suspend and restricted-application strategy is likely applicable. Please contact your financial planner or a Social Security office.

Were You Born Between May 1, 1950, & Jan. 1, 1954?

If so, then the file-and-suspend strategies are being taken away, but filing a restricted application on your spouse’s earnings record may still be a viable option. If you are married or were previously married for 10 or more years, then at full retirement age you are able to apply for spousal benefits only. This allows you to delay collecting your own benefits until age 70. They will increase by 8% each year between 66 and 70. Please contact your financial planner, or a Social Security office for advice when implementing this strategy.

Were You Born On or After Jan. 2, 1954?

If so, the Bipartisan Budget Act of 2015 has made your Social Security claiming strategy much simpler (and less lucrative). All who fall into this category will be deemed to be claiming the max benefit eligible to them. There is no way to choose which benefit you are collecting. You turn your benefits on, and you get what you are entitled to, whether it be benefits based on your own record or your current/former spouse’s.

An important window is open at the moment for everyone who has reached age 66 or will reach age 66 prior to April 29, 2016. This open window allows those individuals to file for benefits and then suspend them. The ability to file and suspend makes many different Social Security claiming strategies possible. This article is a simplification of complex strategies, and the goal is to make the reader aware of an opportunity that exists. If you believe the topics discussed apply to you, please consult with your advisor or the Social Security Administration.

Samuel Baldwin, CFP, AIF, is a partner at Spencer Financial LLC in Sudbury, Mass. Registered Representative/Securities and Investment Advisory Services are offered through Signator Investors Inc., member FINRA, SIPC, a Registered Investment Advisor, in Andover, Mass. Spencer Financial LLC is independent of Signator Investors Inc. and any of its affiliated companies.