arka38 / shutterstock.com

Maintaining a health revenue cycle in a medical practice comes with myriad moving parts. Numerous external forces, such as economic conditions, government programs (e.g., the Zone Program Integrity Contractor [ZPIC], the Health Information Technology for Economic Clinical Health [HITECH]) and legislation passed under healthcare reform, mandate healthcare organizations to begin managing internal processes, such as claims submission, to ensure office compliance and accurate reimbursement.

To optimize reimbursement and maximize revenue, practices must submit clean claims. A clean claim is defined by Medicare as a claim “that has no defect, impropriety, lack of any required substantiating documentation—including the substantiating documentation needed to meet the requirements for encounter data—or particular circumstance requiring special treatment that prevents timely payment.”1

This means a clean claim is one that was accurately processed and reimbursed the first time it was submitted to the payer. Unfortunately, submitting clean claims and reducing a practice’s denial rates can be challenging due to complex and changing payer policies and procedures. Various best practices can be put in place to ensure the submission of clean claims and improve the revenue cycle flow.

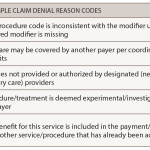

Setting up continuous, proactive methods can minimize the submission of incomplete or inaccurate claims. First, all staff, including physicians and healthcare professionals, need to understand all payer rules, including those set by Medicare and other third-party payers. Second, practices should have a process in place for analyzing and reviewing denials and underpayments in an effort to identify the root cause of the denial (e.g., internal or external).

A substantial amount of time and resource utilization are invested in the resubmission of claims. Keep in mind that each time a carrier denies a claim, it must be revisited: The denial has to be identified, appropriate action has to be taken, and the claim cycle must begin again.

Practice administrators can develop reports to track and monitor denials to detect areas of vulnerability in the practice to maximize the number of claims paid on the first submission. Below are three areas practices should evaluate for improvement to ensure the ratio favors clean claims submission:

Ensure Correct & Updated Patient Information on Claims

Best practices start at the front desk, where accuracy in data entry of the patient’s demographics and insurance information begins. Insurance coverage verification and keying in which insurance is primary and which is secondary is very important for claims submission. Also, staff must confirm patient responsibility at the time of the visit, accounting for the deductible, co-insurance or copay.

The key benefits of this best practice are to prevent lost or delayed revenue from billing the incorrect insurance and to maximize cash collections at the time of the patient encounter.

Check Prior Authorizations at Least 5 Days Prior to the Date of Service

Prevention of lost revenue due to the lack of prior authorization denials is a key area in claims submission. Every procedure or drug therapy that requires prior authorization must be completed before the patient’s visit. Although this is not 100% preventable for denials, due diligence should be adhered to on the practice end, which can be helpful in appealing a denial.

Payer Policies & Coding Guidelines

Being aware of and understanding Medicare local coverage determination (LCD) policies, as well as private payer contracts, are vital to reduce denied claims. All practice staff should understand individual payer policies and coding guidelines, because they usually include what is covered and not covered. Before submitting any claim, all procedural and diagnosis codes should be reviewed and scrubbed if necessary. Ensuring that all CPT, ICD-10 and HCPCS codes are appropriate for the service before submitting to the payer can help reduce the percentage of claims denied, delayed or partially paid, since this affects the practice’s revenue.

Maintain Vigilance

The areas mentioned above are just a few of the key areas of practice management that should be reviewed on a quarterly basis. To continuously improve effectiveness and efficiency of the revenue cycle, in-depth policies and procedures are needed to support a continuous learning model in the practice. The practice policies and procedures should include:

- Developing a well-documented claim-correction process;

- Trending issues by payer to identify critical issues;

- Collecting accurate documentation on all payer-related issues to support effective contract negotiations;

- Creating a teamwork approach for clinical services, patient accounting and contracting to understand the revenue cycle of the practice;

- Creating a culture of accountability for departments, teams and individuals; and

- Tracking preventable denials back to the source for a permanent fix.

By ensuring only clean claims are submitted, practices can work toward processes to make these crucial elements a part of your practice’s operational flow. Clean claims lead to an efficient practice with faster reimbursement and an organized work flow.

For questions on claims submissions, coding, insurance or general practice management, contact the ACR practice department at [email protected].

Reference

- Medicare Managed Care Manual (Rev. 83). 2007 Apr 25.