First published July 12, 2023. Edited Aug. 14, 2023, to add links to patient information. Reposted Sept. 7, 2023, in honor of Rheumatic Disease Awareness Month.

In 2023, several biosimilars to adalimumab (Humira) entered the U.S. marketplace, including the first to be designated interchangeable by the U.S. Food & Drug Administration (FDA)—adalimumab-adbm (Cyltezo). These are the first subcutaneously administered biosimilar products for patients with rheumatic diseases. Clinicians will need to quickly adapt and educate patients as it becomes clearer how this will impact the availability of treatments and patient choices.

Background

Marcus H. Snow, MD, associate professor in the Division of Rheumatology at Nebraska College of Medicine, Omaha, has been working with the ACR’s Committee on Rheumatologic Care on biosimilar topics for several years. He notes that six or seven years ago, clinicians were generally more hesitant about biosimilars, but people have gained comfort with their medical effectiveness and safety since then.

Clinicians have actually been using biosimilars for years, although not under that name, Dr. Snow points out. “We think of our bio-originators as static, but through the years, they change. For example, when we compare Humira when it hit the market to today, it’s slightly different. In a way, it’s a biosimilar of itself.”

Rheumatologists have gained some experience prescribing biosimilars through infliximab-dyyb (Inflectra), a biosimilar of infliximab available in the U.S. since 2016. Since that time, two more infliximab biosimilars have launched. However, the use of infliximab is much more limited than adalimumab, one of the most profitable therapies of all time.

The FDA approved Amgen’s adalimumab biosimilar, adalimumab-atto (Amjevita), in 2016, and many thought the biosimilar would enter the market soon after. But years of legal battles with AbbVie over Humira patent violations postponed the launch, with a settlement finally delaying its entry to the U.S. market until January 2023.

Eight other adalimumab biosimilars launched in July: adalimumab-adbm (Cytezlo), adalimumab-adaz (Hyrimoz), adalimumab-aqvh (Yusimry), adalimumab-bwwd (Hadlima) and adalimumab-atty (Yuflyma), followed shortly thereafter by adalimumab-fkjp (Hulio), adalimumab-afzb (Abrilada) and adalimumab-aacf (Idacio).

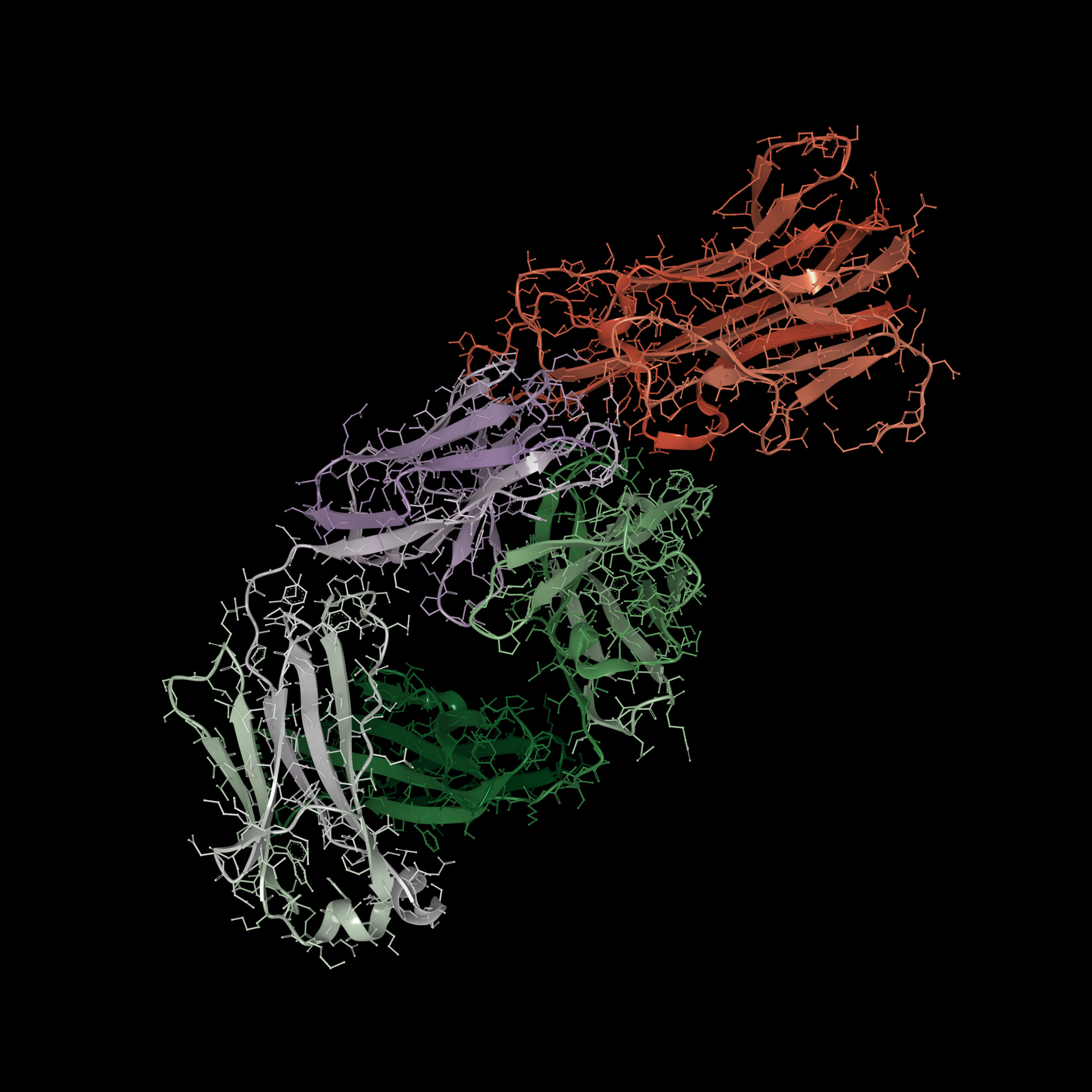

These products vary in their available concentration, formulation (i.e., citrate or citrate free) and mode of administration (e.g., pen vs. syringe), but all have gone through an abbreviated approval pathway to achieve biosimilar designation by the FDA, meaning they have no clinically meaningful differences in terms of safety, purity and potency from an existing, approved biologic reference product.1

Simon M. Helgott, MD, associate professor of medicine in the Division of Rheumatology and Immunology at Harvard Medical School, Boston, and former editor of The Rheumatologist, agrees that clinicians are mostly feeling confident about biosimilars from a purely medical perspective. He does have concerns about immunogenicity and effectiveness in patients who may have to switch biosimilar versions multiple times for insurance reasons; that’s an aspect the FDA never specifically studied. However, some studies from Europe, where adalimumab biosimilars have been available since 2018, offer reassurance.

“Insurance for patients changes frequently,” Dr. Snow adds, “and the formulary changes frequently. If I knew what would be covered for the next five years, I would choose that adalimumab version because I would ideally not have it changed multiple times. But at the same time, it’s reassuring that these drugs have been proved to be equal in how they work.”

Biosimilar Rollout

It’s still unclear how payers will opt to handle reimbursement and availability of the new biosimilar products relative to the reference biologic and other biologics that don’t have biosimilars.

Dr. Helfgott notes that, unfortunately, little information has been available to help providers plan. “The learning curve is going to be very steep because, very quickly, many patients are going to be thrown into this situation,” he says.

Earlier this year, notes Dr. Snow, many formularies were carrying both adalimumab-atto (Amjevita) and adalimumab (Humira). But it’s unlikely that individual formularies will opt to carry all the new adalimumab biosimilars. It’s unclear whether payers will prefer adalimumab (Humira) and not cover biosimilar products, cover biosimilars at parity to adalimumab or prefer biosimilars over adalimumab and potentially over some biologics without a current biosimilar equivalent. At least two major payers have announced they will cover a few adalimumab biosimilars at parity.

Kamala Nola, PharmD, MS, associate dean for academic affairs and professor of pharmacy practice at Lipscomb University, Nashville, Tenn., adds, “It’s not clear if all the adalimumab biosimilars are going to be equally available or if one is going to become more dominant in the market. We don’t know how the key formularies are going to handle it yet.”

Dr. Nola points out that pharmacies will initially find it challenging to keep multiple adalimumab biosimilars properly stocked before it becomes clear which biosimilars will be prescribed and placed on formularies.

Pharmacy benefit managers (PBMs) will play a large role in determining which adalimumab biosimilars are dispensed. These companies function as intermediaries between insurance companies and biotech manufacturers, negotiating contracts and settling on a purchase price. This price is further influenced by rebates the manufacturer grants to the PBM according to sales volume.

“It’s conceivable that AbbVie may decide to remain highly competitive and carve out better deals with PBMs to maintain its market share,” says Dr. Helfgott. “If that’s the case, for a lot of plans, nothing will change.”

It is to the advantage of PBMs to have higher list price medications on their formularies, notes Dr. Snow, because their reimbursement is partly based on the list value.

“I think a lot of people’s concerns are that the objectives and goals of the PBMs are not always aligned with the objectives and goals of the patient or the prescriber,” says Dr. Helfgott. “We’re going to have new products on the market, and what the prescriber may think is the appropriate thing to do may not be what the PBM has in mind at all.”

The ACR supports the use of biosimilars in biologic-naive patients for whom the product is the best option, notes Dr. Snow, citing the ACR’s position statement on the topic. However, the statement also makes it clear that patients on a biologic without a biosimilar available should not be switched to a biosimilar of another class without medical reason. The ACR advocates that the decision to switch from a reference biologic to a biosimilar lie with the clinician and the patient.2

“Insurance-mandated switching takes the decision out of the hands of the rheumatologist and the patient,” says Dr. Snow. “It can be frustrating because when you find something that works for a patient who has had tenuous control of their disease, the last thing you want to do is to change what has been working. It is especially frustrating when this is due to a contractual change at the insurance level and not a change based on what the patient needs at that moment.”

“I do not think that the insurance companies or the PBMs will care whether the patients have previously been on a biologic or not,” says Dr. Helfgott. “We’ve seen this behavior many times before, where payers make mandates and [force changes on] patients who are doing well on their current drugs.”

When a biosimilar has also been designated “interchangeable” by the FDA, pharmacists can switch a product without first checking in with the prescribing physician. Only one adalimumab biosimilar, adalimumab-adbm (Cytezlo), has gone through the additional studies required by the FDA to achieve interchangeability status.3

Currently, 47 states allow substitutions of “interchangeable” biosimilars, although pharmacists must send a change notification to the clinician within a certain time frame after they make the switch. At present, 40 states require the pharmacist notify the patient before they substitute an interchangeable biosimilar—thus, at the time the drug is dispensed.4 The FDA is currently reviewing adalimumab-afzb (Abrilada) for interchangeability status, and experts expect that adalimumab-atto (Amjevita) and adalimumab-bwwd (Hadlima) will also attempt to achieve it.3

Dr. Nola notes that interchangeability status may influence the inclusion of certain biosimilars over others in each payer’s formulary. However, even for non-interchangeable products, insurance companies may effectively force a change for patients by deciding which reference biologic and biosimilar products they will cover.

Financial Impact

One of the main draws of biosimilars is their potential to provide cost savings to the medical system, some of which would hopefully be passed on to patients. Biosimilars are less expensive to develop than their reference products because much of the basic science was established during development of the reference product. Theoretically, this should allow for less expensive biosimilar products on the market, which should also push down the cost of the reference biologic.

In Europe, the introduction of adalimumab biosimilars has resulted in steep price discounts and increased patient use. When infliximab-dyyb (Inflectra) first launched, its list price was only 10% less than that of infliximab (Remicade) in the U.S. However, after four years, the price for both the biosimilar and for infliximab itself has dropped by 50%.5

Due to the complexities and contradictions embedded in the U.S. healthcare market, it’s unclear if similar drops will be seen for adalimumab biosimilars, which are handled differently from infusion products in terms of insurance coverage. Although adalimumab-atto (Amjevita) was introduced at 55% of the current wholesale price of adalimumab (Humira), its list price is only 5% below the current adalimumab list price.3

Some analysts speculate that AbbVie is likely to increase its rebates to PBMs to remain competitive with the adalimumab biosimilars and retain its preferred status on most formularies. By increasing its PBM rebates a relatively small amount, it may be able to match the net cost of biosimilar manufacturers, who also must pay AbbVie royalties. If this is the case, adalimumab biosimilars may not gain traction in the market and prices may not decline.6

“I would love to say that my patients are going to pay less, and biologics are going to be more available because they’re cheaper,” says Dr. Snow. “But we have no proof of that yet. I hope that we reach that goal eventually, but it is unknown at this time.”

It’s also unclear whether treatment assistance programs will be available for biosimilar products similar to those currently available for Humira and other reference biologics. However, Dr. Helfgott believes some form of these programs are likely to remain available due to various tax and legal considerations.

Physician Burden & Communication

Although it’s unlikely patients currently on a biologic will have to undergo an additional round of prior authorizations to be moved to a biosimilar, the introduction of so many biosimilars at once will not make the process any easier. “It’s already a huge burden on practices to navigate prior authorizations,” says Dr. Snow, “and it’s only going to [get worse].”

Dr. Nola encourages rheumatologists to lean on specialty pharmacists, where available, because they can help with prior authorizations and navigating the overall introduction of biosimilars. “These pharmacists are a good resource in terms of figuring out which products are actually going to be available and which ones plans will cover,” she says.

The patient education and reassurance aspect will also be important during this rollout, especially for patients happy with their reference biologic. A survey conducted in 2020 and 2021 found that two-thirds of patients were unfamiliar with the concept of biosimilars. Patients had concerns about safety, side effects and financial support for the biosimilar. However, after receiving some basic education, the majority were open to considering biosimilars, especially if cost considerations were factored into the decision. Patients also wanted to be informed if a switch to a biosimilar was going to occur.7

Dr. Nola dislikes the use of the word “generic” in educating patients, although she acknowledges it is a term with which patients are familiar. But generics are typically small molecule products, and biosimilars are much more complex. “It’s important for patients to understand that these biosimilars have been deemed similar enough, structurally and chemically, to whatever product they may have been on previously,” she says. “Patients should understand these drugs are just as good as these other agents out there, and that there should be no differences clinically or from a safety perspective.”

Moving Forward

These adalimumab biosimilars are only the first step toward expansion of such agents. The FDA is currently reviewing two ustekinumab biosimilars, with decisions likely to come in fall 2023, with more under development. The FDA is also reviewing a biosimilar for tocilizumab, with a decision expected later this year. Other biosimilar products, such as for secukinumab, are also under development.5

Hopefully the transition will be relatively smooth for patients and providers. “I’m not as concerned about which biosimilars I’m going to be asked to use,” says Dr. Helfgott. “I’m more concerned about the patients’ perspective, whether they are going to have the same copayments and access to the product and so forth. As long as that isn’t made more challenging, I think it should be okay.”

On Sept. 12, the ACR launched a patient education campaign, Biosimilars & You: A Guide for Patients with Rheumatic Disease as part of Rheumatic Disease Awareness Month (RDAM). Review and download the materials here.

Ruth Jessen Hickman, MD, is a graduate of the Indiana University School of Medicine. She is a freelance medical and science writer living in Bloomington, Ind.

References

- Jeremias S. First round of adalimumab biosimilars launches in July. American Journal of Managed Care. The Center for Biosimilars. 2023 Jul 2.

- American College of Rheumatology Position Statement: Biosimilars. Committee on Rheumatologic Care. [n.d.]

- Jeremias S. US welcomes first adalimumab biosimilar, Amjevita. American Journal of Managed Care. The Center for Biosimilars. 2023 Jan 31.

- Breaking down the hottest topic in pharmacy—Humira biosimilars. Goodroot. 2023.

- Joszt L. New biosimilars poised to make waves. Drug Topics. 2023 Feb 27.

- Contreras B. The future of savings in Humira biosimilars are [sic.] low. Managed Healthcare Executive. 2023 Jan 29.

- Gibofsky A, Jacobson G, Franklin A, et al. An online survey among US patients with immune-mediated conditions: Attitudes about biosimilars. J Manag Care Spec Pharm. 2023 Apr;29(4):343–349.