Could you use an additional $50,000 to $80,000 in revenue each year? If you are like most clinicians, you have superbills and well-trained office staff but you still receive frequent denials. Though some denials are appropriate, many can be corrected and the lost revenue recovered.

Most practices nationwide have a 5% to 8% denial rate, according to the April 2004 issue of Physician Practices. This means that in a practice with a $1 million revenue stream, denials potentially represent between $50,000 and $80,000 in lost revenue.

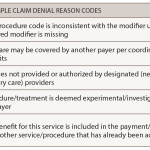

Reports show that 50% of denied claims are never refiled; this represents significant lost revenue—much of which doesn’t have to be lost. According to the Healthcare Advisory Board, 90% of denials are preventable and 67% are recoverable. Given the magnitude of these numbers, a targeted denial management strategy should result in a significant revenue increase to the typical practice. The key to recovering additional income is managing denials.

Denial management requires time and resources—but can benefit your practice if the recovered reimbursements ultimately improve your bottom line. Here are some tips for creating a successful denial management program in their office:

- Make decisions in advance: Analyze your denials to see if there are common patterns from individual payers. Determine which payers you will target, define denial reasons you’ll investigate, and use your billing system to evaluate and follow up on over- and underpayments that might reflect negatively on accounts receivable.

- Prepare a detailed implementation plan:

Sample Implementation Checklist:

- Make phone inquires to clarify what is needed if a claim is denied;

- Refile a corrected claim and send by certified mail; and

- Follow up with a phone inquiry to verify receipt of the corrected claim and confirm when the claim will be reprocessed.

If this all seems onerous, remember that lost revenue is likely to increase if you don’t manage your denials. Physicians should understand their practice’s current revenue cycle performance statistics. At a minimum, examine the following statistics:

- Days in accounts receivable;

- Net cash collections percentage; and

- Outstanding accounts receivable percentage by the age of the claims.

Denial management can be time and resource intensive to implement—especially for small solo practices—but recovered revenues make it worth the effort.