NEW YORK (Reuters)—A new class of blood thinners that competes with widely used warfarin should get a boost next year when an “antidote” that can reverse the medications’ effects in an emergency is expected to enter the market, according to top U.S. heart doctors and investors.

Xarelto, from Bayer AG and Johnson & Johnson, and Eliquis, sold by Bristol-Myers Squibb and Pfizer, were approved as safer and more convenient alternatives for preventing blood clots and strokes than warfarin.

But there was one hitch: There was no way to quickly restore normal clotting for patients in need of emergency surgery or to stop a major bleeding episode, leading many doctors to hold off on prescribing the drugs.

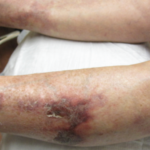

“It may be uncommon, but they’re memorable when they happen,” Dr. Charles Pollack, an emergency physician at Thomas Jefferson University Hospital in Philadelphia, says of major bleeding events.

“We didn’t have a specific reversal strategy for these drugs, and I think that left people feeling a bit insecure,” adds Pollack, who has done clinical work on a recently approved antidote to Boehringer Ingelheim’s rival blood clot preventer Pradaxa.

That is about to change.

Small drugmaker Portola Pharmaceuticals this month applied for U.S. approval of a drug called andexanet alfa that rapidly reverses the effect of Xarelto and Eliquis. It is expected to enter the market in 2016.

“It will make a big difference,” says Dr. Mariell Jessup, a cardiologist at the University of Pennsylvania Medical Center. “I have many physicians, particularly surgeons, who hate these drugs. They’re frightened of them because they’ve had to deal with the consequences of somebody coming in with trauma,” while using the new blood thinners.

The new drugs cause fewer major bleeding episodes than warfarin and do not require dietary restrictions or constant monitoring as with the decades-old medicine. But major bleeding remains the most worrisome risk of all anticoagulant therapy as it can be fatal or cause debilitating, long-term problems.

Bristol-Myers reported $466 million in global third-quarter sales of Eliquis, which won U.S. approval at the end of 2012, about 18 months after Xarelto. J&J posted U.S. Xarelto sales of $461 million in the quarter, while Bayer reported about $509 million in international sales.

There is still a lot of room to grow as warfarin, also prescribed under the brand name Coumadin, commands some 60% of the blood thinner market. Morningstar expects annual sales for Xarelto and Eliquis could reach $8 billion for each.