LOS ANGELES (Reuters)—A new front in the battle over the cost of expensive medicines in the United States is opening up in Oklahoma, the first state where the government’s Medicaid program is negotiating contracts for prescription drugs based on how well they work.

In June, Oklahoma received approval from the U.S. Centers for Medicare and Medicaid Services to factor how effective a prescription medicine is into the price it pays to the manufacturer.

The state has signed its first contract under this strategy with Alkermes Plc for injected schizophrenia treatment Aristada (aripiprazole lauroxil), and is close to new agreements for an expensive antibiotic and an epilepsy drug, Nancy Nesser, pharmacy director at the Oklahoma Health Care Authority, told Reuters.

An Alkermes spokesperson said the arrangement is intended to “encourage patients to stay in treatment longer and meet treatment goals.” List prices for the long-acting drug, given every month to six weeks, start at about $1,200 a month. Under the one-year contract, the price decreases every other month as long as the prescription is refilled.

“The longer the member takes it, the better the rebate,” Nesser said.

State-run Medicaid departments are powerful purchasers in the $450 billion U.S. market for prescription medicines. By law, the health program for the poor and disabled receives a mandatory 23 percent discount off drug prices, and often negotiates additional rebates for individual medicines.

But state governments have struggled to keep up with steep drug price increases each year, as well as expensive new medications for diseases including hepatitis C and cancer.

President Donald Trump has promised to lower prescription drug prices, and in May unveiled a “blueprint” with dozens of proposals to deliver on that pledge.

One proposal would allow some state Medicaid departments to exclude certain drugs from reimbursement, a tactic used by private insurers to demand larger discounts and one that would represent a more significant change. But it is not yet clear how states could do so under federal law without losing existing statutory rebates, healthcare experts said.

In the meantime, Oklahoma’s move can give the state more leverage over drugmakers, state officials say.

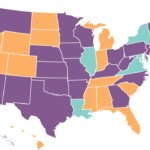

Other states are considering whether to follow Oklahoma’s lead, according to Nesser, who has fielded inquiries from several Medicaid departments.

Michigan’s Department of Health and Human Services – which spends nearly $2.4 billion annually on drugs for Medicaid members – told Reuters it will request approval for a program similar to Oklahoma’s, although details are still being worked out.

“This type of arrangement has the potential to improve the quality, value and efficiency of drug-based treatments,” Michigan Department of Health spokesman Bob Wheaton said in an email.

Colorado’s Department of Health Care Policy and Financing said it is in the “early planning stages” of a request to pursue value-based Medicaid drug purchasing contracts.

SAVINGS TBD

To be sure, it remains unclear how much money these new value-based programs will save, and whether enough drugmakers will get on board since their participation is voluntary. Oklahoma is working with the University of Oklahoma to study whether the new contracts save money over time.

The state has yet to secure agreements for treatments that take up a major portion of its $650 million in Medicaid spending, such as attention deficit/hyperactivity disorder therapies for children.

In the meantime, the biggest hurdle is just finding pharmaceutical companies that are willing to work with the state, Nesser said. “Mostly we are talking to smaller companies.” Approaches to cancer drugmakers in particular have so far led nowhere: “We got the door slammed in our face,” Nesser said.

Industry trade group Pharmaceutical Research and Manufacturers of America said it supports Medicaid efforts to use value-based contracting for new medicines, but said states need to make sure patients still have access to current prescriptions.

Smaller companies, particularly those with newer drugs, may have more of an incentive to use such deals as a lever against large rivals.

Alkermes’ sales of Aristada totaled $93.5 million last year, dwarfed by the $3 billion in sales for Johnson & Johnson’s long-acting antipsychotics including Risperdal Consta (risperidone) and Invega Sustenna (paliperidone palmitate).

The new Medicaid agreement in Oklahoma may help Alkermes in its sales pitch to doctors, including for Aristada Initio – approved last month as the first antipsychotic injection that does not require patients to begin treatment by taking oral pills for several weeks.

Nesser said other rebates under negotiation would be structured differently than the Alkermes deal. They could link the price of a drug to its impact on other costs, such as emergency room visits and hospitalizations, or give higher-rebate products preferential status over similar treatments.