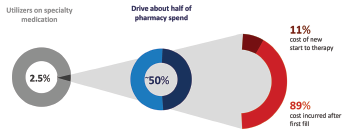

Specialty pharmacy utilizers

Source: CVS Health Enterprise Analytics

Presenters at the Access in Rheumatology meeting held in advance of the ACR’s State-of-the-Art Clinical Symposium took a deep dive into the access challenges faced by rheumatology patients and discussed possible solutions.

Treatment

At least until 2026, prescription drug spending will exceed the U.S. gross domestic product (GDP) and health spending, said rheumatologist Colin C. Edgerton, MD, American Rheumatology Network, Charleston, S.C. Much of that spending is attributed to the purchase of specialty drugs, including those prescribed by rheumatologists.

High drug prices and recent drug shortages, such as for hydroxychloroquine and methotrexate, are among the healthcare access challenges rheumatology patients face. One example Dr. Edgerton discussed was a 100% increase in the price of adalimumab over the past five years. The trends of higher drug prices and shortages lead to prescription abandonment and lack of adherence, he said.

High drug costs have led to an increase in prior authorization requirements, with one American Medical Association survey cited by Dr. Edgerton showing two hours of physician paperwork spent for every hour of direct patient care. “It’s a leading source of physician dissatisfaction,” he said.

Dr. Edgerton outlined the growth of value-based medicine that focuses on higher quality and lower costs, even for some rheumatology drugs and shared barriers that rheumatologists often face when tracking outcomes, due to smaller practice sizes and the financials involved with tracking analytics.

Specialty Drug Prices

Dr. Chaguturu

Sree Chaguturu, MD, chief medical officer for CVS Caremark, offered a perspective on the role of pharmacy benefit managers and shared more data on the high costs involved with specialty drugs. One example: Specialty medications are used by only 2.5% of the total population, but account for about 50% of the total drug spending. The majority of those costs are incurred by those who continue on therapy rather than newer users, he explained.

The use of specialty medications will only increase going forward. Of 537 drugs in the drug pipeline over the next three years, 355 are specialty drugs. There also are 283 existing drugs that will have new specialty indications, Dr. Chaguturu said. “This is fantastic for new opportunities to manage comorbidities and patient conditions, but sponsors want to make sure there is appropriate access and pricing.”

Gene therapy and hyperinflation are adding to costly therapies, but biosimilars are mitigating these by creating competition and potentially lowering costs, Dr. Chaguturu said.

The entry of biosimilars to the market has been slow in the U.S. compared to Europe, but will eventually assist with cost savings, Dr. Edgerton said.