Physicians are increasingly fighting multiple forces in running a practice, and one of the most common barriers to effective revenue cycle management is frequent medical billing and claim denials. An insurance company’s denial for services places a significant strain on the financial process of the practice, which affects the bottom line. According to the Medical Group Management Association (MGMA), even the best-performing medical practices have 4% of their claims denied.

Tracking patient care episodes, from appointment scheduling to registration and payment balance, falls under the revenue cycle management. Healthcare revenue cycle management is the financial system that facilities use to manage the administrative and clinical functions associated with billing claims, payment and revenue generation. The process encompasses the identification, management and collection of patient service revenue. This is a growing area of concern as the healthcare arena shifts to value-based care, which puts added pressure on providers to improve quality of care and manage taking on higher risks and decreasing reimbursement. With this shift, examining the business strategies of the practice is vital for success and should include creating new procedures and guidelines. But this is not a one-time occurrence; ongoing analysis and review of the practice’s financial operations should be managed consistently to reduce costs and increase the practice’s financial health.

SkyPics Studio / shutterstock.com

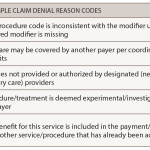

Frequent denials and rejected claims are two of the top areas that negatively affect the revenue cycle of practices. It is helpful to understand the basics of claims denials to better manage the revenue cycle of billing claims, which include capturing the correct patient information, insurance coverage and eligibility and claims submission. Below, each area is outlined with simple prevention and management steps to improve and/or minimize denials.

Patient Information

Many claim denials are due to simple data-entry errors. Failure to collect accurate patient information and verify insurance coverage comes from registration-related mistakes. This often includes misspelled names, incorrect genders and/or incorrect member numbers. The patient’s account must be accurate from the beginning, and this lays the foundation for claims to be billed and processed. Having a claim kicked back from any payer due to patient demographics is an unnecessary denial in the revenue cycle flow.

Registration-related errors can be minimized, starting by front desk staff collecting accurate patient information during the scheduling of the appointment, at check-in, as well as at check-out. Instead of asking patients if there are any changes, it may be a good practice to have patients review a printout of their demographics and sign that the data are up to date and correct. Implementing claim-scrubbing software to review patient information before submission is another route to prevent denials for patient demographics.