Physicians are increasingly fighting multiple forces in running a practice, and one of the most common barriers to effective revenue cycle management is frequent medical billing and claim denials. An insurance company’s denial for services places a significant strain on the financial process of the practice, which affects the bottom line. According to the Medical Group Management Association (MGMA), even the best-performing medical practices have 4% of their claims denied.

Tracking patient care episodes, from appointment scheduling to registration and payment balance, falls under the revenue cycle management. Healthcare revenue cycle management is the financial system that facilities use to manage the administrative and clinical functions associated with billing claims, payment and revenue generation. The process encompasses the identification, management and collection of patient service revenue. This is a growing area of concern as the healthcare arena shifts to value-based care, which puts added pressure on providers to improve quality of care and manage taking on higher risks and decreasing reimbursement. With this shift, examining the business strategies of the practice is vital for success and should include creating new procedures and guidelines. But this is not a one-time occurrence; ongoing analysis and review of the practice’s financial operations should be managed consistently to reduce costs and increase the practice’s financial health.

SkyPics Studio / shutterstock.com

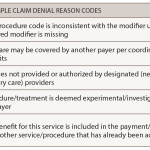

Frequent denials and rejected claims are two of the top areas that negatively affect the revenue cycle of practices. It is helpful to understand the basics of claims denials to better manage the revenue cycle of billing claims, which include capturing the correct patient information, insurance coverage and eligibility and claims submission. Below, each area is outlined with simple prevention and management steps to improve and/or minimize denials.

Patient Information

Many claim denials are due to simple data-entry errors. Failure to collect accurate patient information and verify insurance coverage comes from registration-related mistakes. This often includes misspelled names, incorrect genders and/or incorrect member numbers. The patient’s account must be accurate from the beginning, and this lays the foundation for claims to be billed and processed. Having a claim kicked back from any payer due to patient demographics is an unnecessary denial in the revenue cycle flow.

Registration-related errors can be minimized, starting by front desk staff collecting accurate patient information during the scheduling of the appointment, at check-in, as well as at check-out. Instead of asking patients if there are any changes, it may be a good practice to have patients review a printout of their demographics and sign that the data are up to date and correct. Implementing claim-scrubbing software to review patient information before submission is another route to prevent denials for patient demographics.

Insurance eligibility and authorization are also key components of the patient profile. To avoid denials for insurance coverage and/or obtaining authorization for any procedure that requires it, using payer online tolls to verify eligibility and checking authorization can be an easy approach to minimizing claim rejections. It is a good habit for staff to verify a patient’s benefits before any service is provided and to always get a copy of a patient’s insurance card at each visit.

Coding Errors

With the advent of ICD-10 diagnosis and the Current Procedural Terminology (CPT) coding guidelines and complexity of requirements in a patient’s medical record, coding errors are becoming an increasingly growing cause for claim denials.

Medical necessity is another mounting coding issue. Keep in mind that CPT codes indicate the service performed; and the ICD-10 code gives the reason for the patient being in the practice for service. Some patients may have more than one diagnosis and may need several services. Other patients may need a service that is covered only for a specific diagnosis. A simple coding error in practice is linking the correct diagnosis to an inappropriate CPT code for the office visit or procedure.

Another coding area to monitor is the use of unspecified or nonspecific diagnosis codes. ICD-10 codes consist of three-, four- and five-digit codes. Practices should always verify the diagnosis provided by the physician and bill to the highest level of specificity, because this can be the key to prevent claim denials. Most practices have implemented electronic health records, but it is a good idea to have a coder or claims specialist review claims before final submission to confirm that there are no incomplete or inaccurate codes on the encounter form.

One strategy for prevention and management of coding errors is to identify your practice’s most common diagnosis and service codes and have a cheat sheet for all coding and billing staff to have on hand when reviewing claims.

Claims Submissions

Although claim submission requirements may vary, all payers have a certain timeframe for providers to submit their claims after a service is rendered. It is not uncommon for practices to have a backlog in the billing department, but if claims are not submitted to a payer within the designated timeframe, then the claim is likely to be rejected. Time limits for claim submissions can range from 10–90 days from the date of service. To avoid any mistakes in billing, there should be a list of accepted payers for your practice with their claim-submission requirements. This will need to be a living document and should be monitored and updated based on payer guidelines. It’s also a good idea to have your claims receipt logged in your system in case a payer rejects a claim, citing late submission.

Duplicate claims can be problematic for a practice, and the revenue cycle as well. If a duplicate claim is submitted due to nonpayment the first time, the duplicate claim will be denied and may slow the reimbursement process. To prevent this, it is sometimes best to check with the payer to see what steps you should take before resubmitting a claim.

Understanding these common reasons for denied claims is the first step in the success of a practice’s revenue cycle management. Preventing and managing claim denials are not easy tasks for any rheumatology practice, but putting key preventative measures in place can be the first step in the process. It is important to take the necessary steps to identify, resolve and manage denials to keep your practice on track. It is essential that all financial issues be managed properly from the moment the patient initiates an appointment to the final processing of payment.

Communication and training are at the heart of revenue cycle management. Understanding the main drivers of the revenue cycle, which include internal and external factors, is a key step in effective revenue cycle management. The ACR practice management department is devoted to helping members improve billing, collections and practice management strategies.

For more information on training and education in denials and revenue cycle management, contact the ACR practice management department at [email protected].