It is essential that every physician practice verify the insurance eligibility and benefits of patients before services are provided. There are many missed opportunities to secure income and reduce staff time when patient eligibility is not verified at the time of check in. Training staff to complete this task can help boost revenue at time of service and save time on the back end.

As a general rule, new and returning patients should always bring their insurance identification card to every visit. The front desk staff is responsible for checking in patients and should make it a priority to check the patient’s insurance carrier to ensure the information on the card is up to date and correct for that date of service. This can often be accomplished by checking the insurance carrier website or calling a benefits representative. Some practice management systems and clearinghouses can verify patient eligibility. If staff encounters problems with a patient’s insurance verification, policies should be in place to have the patient pay for the services in full and file the insurance claim themselves. For those with financial need, there should be an option for patients to make payment arrangements.

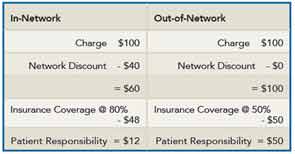

Office staff should confirm whether the patient’s plan will consider the specialist an in-network or out-of-network provider. This is vital, because it will affect who is responsible for the main part of the bill. The primary advantage of determining that the physician is an in-network provider is to allow the physician to receive a negotiated or discounted rate for the services, and the patient’s insurance generally picks up a larger portion of the bill. If the physician is an out-of-network provider, then the patient will need to pay their portion of the bill at the time of the visit.

Here is an example of how the network affects payment. A visit to an in-network physician may cost $100 for an office visit. The insurance company has contracted with you to discount this visit to $60. If the insurance company covers 80% of the cost, the patient responsibility would be $12. Compare that with an out-of-network physician who also charges $100 for the visit. Without the negotiated rate from the insurance company, the patient’s cost will remain $100. For out-of-network providers and care, the insurance may cover only 50%, making the patient’s responsibility $50.

There is also co-pay for a specialist visit, which is sometimes different from the co-pay for a primary care encounter, and staff should be aware that this will need to be verified at each visit. Additionally, there should be verification if the services will require a referral or pre-authorization.

Medicare is an insurance plan; it is governed by the federal government, but the same rules apply, and all beneficiary benefits should be checked with the carrier prior to the physician seeing the patient. Many Medicare patients will tell you that they have Medicare and even show their ID cards, not realizing that they are enrolled in a Medicare Managed Care Plan, which is different from traditional Medicare.

Another key area to monitor is scheduling appointments. Because appointments for new patients are generally set up in advance, the insurance information should be collected at the time the appointment is made, which will allow staff to check the information prior to seeing the patient. You can avoid many delays if you know what the patient’s financial responsibility is before seeing the patient. This will also help the patient plan to pay the portion of the bill for which they are responsible.

One standard rule that should be adopted in rheumatology practices for all established patients is that benefits should be verified on each date of service. This is a good policy to ensure the patient still has the same coverage benefits for the date of service. Keep in mind that a patient may lose his or her coverage between services or a range of treatments.

It is best to create a form for your staff to use when checking patient insurance eligibility and benefits to ensure they don’t forget important information. Some key items that should be included on the checklist are:

- Correct spelling of the patient’s name

- Aliases or nicknames

- Date of birth

- Address

- SS number

- Insurance carrier name

- ID #

- Group #

- Insurance carrier phone number

- Is authorization required?

- Is a referral required?

- Is there a deductible?

- Address for claims submission

- In-network or out-of-network status

If this vital set of information is gathered prior to treating the patient, your office will see a much improved flow of reimbursement for the services rendered. For questions or information on insurance billing and eligibility or other areas of practice management, contact Antanya Chung, CPC, CPC-I, CRHC, CCP, at [email protected] or (404) 633-3777 x818

.